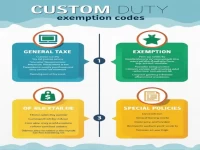

Customs Tax Exemption Codes Explained: Key Factors for Smooth Import and Export

This article discusses the classification and coding structure of customs duty exemption codes, detailing types of import and export goods such as general taxation, gratuitous aid, and other statutory tax reductions. By clarifying the definitions, codes, and applicable ranges for various types of goods, it aids relevant personnel in effectively understanding customs policies, thereby facilitating smooth international trade.